Archer Investment Management’s Emily Rassam Earns CDAA Certification

Archer Investment Management is proud to announce that Senior Financial Planner Emily Rassam has recently passed the CDAA exam and is now a Certified Digital Asset Advisor. Based in Charlotte, North Carolina, Emily has 15 years of experience working at investment firms in New York and North Carolina. Besides becoming Archer's newest CDAA, Emily is also a Certified Financial Planner™️, Accredited Investment Fiduciary Analyst, Chartered Retirement Plans Specialist, and National Social Security Advisor. She joins Owner/President Richard Archer as Archer Investment Management's two current Certified Digital Asset Advisors on staff.

The Certified Digital Asset Advisor program was established in 2020 as the leading provider of Digital Asset education for financial advisors in the U.S. The CDAA designation is awarded to financial professionals who have taken and passed the required coursework regarding cryptocurrency and digital asset education. Financial advisers who have completed the CDAA course have demonstrated that they understand how digital assets work, the role they play, the risks involved, and how they can fit into a financial portfolio.

Archer Investment Management provides financial planning and investment management to Austin professionals. An independent, fee-only investment advisory, Archer Investment Management is a fully-digital, fiduciary firm that works in the best interests of our clients.

For more information, contact:

Richard Archer - [email protected] - 800-840-5946

Austin, Texas

Press Release Service by Newswire.com

Original Source: Archer Investment Management's Emily Rassam Earns CDAA Certification

LendTech Innovator TSLC Wins Two Awards at the 2022 ABF Wholesale and Retail Banking Awards

Roxe Partners With Cebuana to Accelerate Blockchain Payments in the Philippines

NEW YORK - August 4, 2022 - (Newswire.com)

Roxe (www.roxe.io/), a blockchain infrastructure company powering the next generation of payments and digital commerce solutions, today announced a new partnership with the Philippines' micro financial services provider champion, Cebuana Lhuillier. The partnership will facilitate seamless cross-border remittance payments for clients in the Philippines by utilizing Cebuana Lhuillier's diverse fund delivery methods via the Roxe blockchain network.

Blockchain technology is becoming a growing force and mechanism for driving the next generation of global finance solutions. Through this collaboration, Roxe gives Cebuana Lhuillier access to its global partners who will be able to send funds to Cebuana Lhuillier's existing and new clients.

"This partnership is an exciting step forward for Roxe as it gives us a strong distribution network to clients in the Philippines," said Josh Li, Chief Business Officer for Roxe. "The country has emerged as a serious player on the global financial stage, and whether it's disbursing funds to end users' bank accounts or directly allowing cash pickups onsite, all Cebuana clients are now able to receive funds from within the Roxe network."

As one of the Philippines' most trusted and largest micro financial services providers, with over 3,000 physical locations nationwide, Cebuana Lhuillier offers cross-border remittance disbursement through Cash-Pick-Up and Remit-to-Account services available to clients through their branches, agent locations, service providers, and other payout networks and channels.

"The Philippines' remittance market has grown tremendously to become the fourth largest in the world, meaning Filipino citizens are in need of an easier, more dependable, and secured facility for them to send and receive their money, anytime and anywhere," said Jean Henri Lhuillier, Cebuana Lhuillier President and CEO. "This collaboration will allow us to connect to Roxe Inc.'s blockchain network, eliminating key pain points of our clients, while accelerating and optimizing cross-border payments."

Over the past few months, Roxe has ramped up its product and partner expansion and recently added over 40 partners to its global payment community who have integrated Roxe's blockchain technology and Roxe Instant Settlement Network (RISN), and was recently shortlisted as a finalist for the Bank for International Settlements (BIS) G20 TechSprint challenge on central bank digital currencies (CBDCs).

About Roxe

Roxe is a global payment network unlocking the future of finance with fast, flexible and cost-efficient blockchain payment solutions. Roxe's blockchain-enabled network efficiently moves and exchanges value by removing the barriers of time, geography, and currency. Roxe was built to unify the highly fragmented financial market, enabling payment and remittance companies, banks, central banks, and consumers to get the speed and cost savings of blockchain technology, and exchange digital assets without reliance on cryptocurrencies. For more information, visit https://www.roxe.io.

About Cebuana Lhuillier

P.J. Lhuillier, Inc. (PJLI) is the proud parent company of Cebuana Lhuillier, the Philippines' largest micro financial services provider that offers pawning, remittance, micro insurance, bills payment, e-load, business-to-business solutions services, and micro-savings and other banking services through their banking arm, the Cebuana Lhuillier Rural Bank. For more than 30 years, Cebuana Lhuillier continuously provides fast, easy, secure, and convenient micro-financial products and services to more than 30 million customers through over 3,000 branches nationwide. The company has also expanded its services into the digital space through the eCebuana App, a product of the Cebuana Lhuillier Rural Bank, and a host of other financial platforms such as Cebuana From Home, ProtectNow.com and the Cebuana Lhuillier Jewelry website.

Media Contact

Diana Bost

Fusion PR

Press Release Service by Newswire.com

Original Source: Roxe Partners With Cebuana to Accelerate Blockchain Payments in the Philippines

Fidelity Life: Why Seniors Should Consider Getting Whole Life Insurance This Summer

Founder of Cryptocurrency Exchange ZB.COM, Jimmy Zhao, to Serve as SGMCHAIN Advisor

Genesis Mining Announces Genesis Digital Assets, an Industrial-Scale Bitcoin Mining Operator

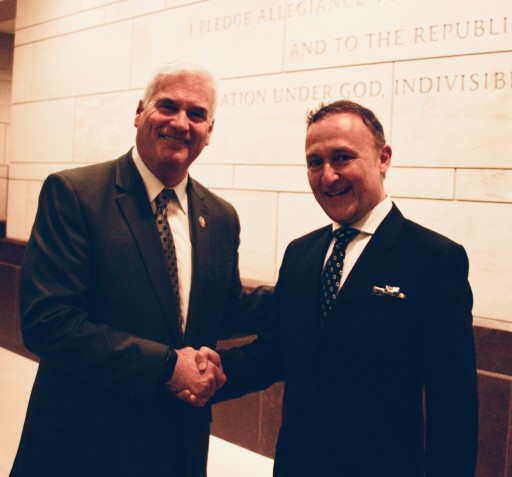

WASHINGTON, July 18, 2019 (Newswire.com) - Omer Ozden, Chairman of RockTree LEX, who was legal counsel to Facebook dating back to 2006, was at the monumental, multi-day Congressional Hearings in Washington, D.C. with other high-profile CEOs of leading Blockchain companies, top Blockchain lawyers and government officials to shape the future laws and policy of Libra, Blockchain and Cryptocurrency in the United States.

RockTree LEX sees Libra and the Congressional Hearings as another major milestone in Blockchain and the financial industry’s rapid evolution into “Wall Street 2.0.” Increased regulatory attention and the fast-growing participation of large financial institutions in the space have upgraded the Blockchain industry with the entrance of Fortune 100 technology companies and global bulge bracket investment banks. Ozden attended Congressional Hearings with Facebook, across open-door and closed-door private sessions with both Democratic and Republican leaders of the U.S. government. These included deep discussions with the Congressional Blockchain Caucus, Co-Chaired by Tom Emmer (Rep), Bill Foster (Dem), Darren Soto (Dem), and David Schweikert (Rep), members of the House Financial Services Committee who led testimony questioning of Facebook’s David Marcus, and closed-door sessions with leading Congressional and Senate members.

“U.S. securities laws created in the 1930s, as regulated by the SEC, are inadequate for regulating cryptocurrencies. The rules surrounding commodities under the CFTC are more suitable, and we should look to other governments that have adopted similar commodities-based regulations for cryptocurrencies, such as those in Japan, Switzerland and Singapore,” stated Ozden to Congressional members.

“Major disruptive technology advances are inevitable. We have done this so many times in human history; it is how they are managed and embraced that sets one economy’s growth trajectory over another’s. What made America great is the “Do No Harm” approach Congress took towards the Internet in the 1990s. This allowed American Internet companies and technology to grow and, eventually, dominate much of the globe. We need to do the same for Blockchain.”

Ambiguity in the U.S. by the SEC up to now has meant many U.S. innovators and large amounts of investment capital leaving the U.S. and choosing to be domiciled in more friendly jurisdictional environments, such as Facebook’s move to Switzerland. Ozden advised Congress “that if the U.S. government falls behind by just two or three years, it is like losing 10 to 15 years in a traditional industry, and the U.S. will be out of the race.”

Ozden told Congressional and Senate leaders that the “top cryptocurrency exchanges, cryptocurrency mining companies and technology companies in Blockchain were predominantly in the United States five years ago. Yet today, the top exchanges and miners are all in Asia or Europe. An example given by Ozden was that of Huobi, which is the largest cryptocurrency exchange in China. “Huobi has worked closely with China’s regulators and has opened large technology teams in a crypto-friendly technology zone in the South of China. The United States should support companies like Huobi and Facebook that take the approach of ‘working with government’ instead of ‘running away from government,‘” stated Ozden.

“The future of Blockchain,” added Ozden at meetings with Congress, is “Wall Street 2.0. It means more regulation. It means more licenses. It means widespread institutional adoption. And it means rapidly increasing liquidity flows and substantial economic growth for those who capture it.”

If Facebook, with its 2.7 billion global users does not dominate the cryptocurrency payments world, then there is always Telegram from Russia, with its 250 million global users, or WeChat from China, with its 1.3 billion global users, plus many more large-scale companies around the world. It is just innovation, and it is inevitable. And it is only a question of where it will occur first on a large scale.

Original Source: Global Blockchain Legal Platform 'RockTree LEX' Fights for the Future of Financial Innovation at Congress

London, May 16, 2019 (Newswire.com) - Crosslake Technologies’ Managing Director, Hazem Abolrous, will reinforce the importance of utilizing strategic nearshore options for portfolio companies at Private Equity International’s Operating Partners Forum: Europe, May 21-22 in London.

“I’m extremely excited to be speaking about this dynamic topic focused on driving value creation at Europe’s leading event focused on Private Equity. We work with Private Equity leadership globally to maximize opportunities and look forward to sharing our steps to success with other operating partners.” - Hazem Abolrous, Managing Director at Crosslake Technologies.

The strategic and operational challenges faced by software businesses today have been intensified by rapid technological advances, sharp competition, and global economics. Hazem has been invited to leverage his 23 years of driving growth through innovation and value creation, including 18 years at Microsoft. Hazem is a thought leader and strategist focused on Private Equity software, programs, and products. Through close collaboration, Hazem's leads Crosslake’s European team who implements holistic approaches and to identify technical risks, opportunities for growth, existing strengths to maximize, and potential areas for cost reductions or additional investment.

“We help our clients effectively tackle strategic and operational challenges, whether in architecture, processes, and tools, or within the organization. I look forward to outlining successful case studies, including an action item checklist to ensure your activities are driving value creation.” - Hazem Abolrous, Managing Director at Crosslake Technologies.

To register for Hazem’s presentation and network with peers from other leading PE firms at Operation Partners Forum: Europe, please visit the conference website here.

About Crosslake:

Founded in 2008, Crosslake helps Private Equity firms drive and realize value creation through software. From strategic vision to planning and architecture, development, and execution, Crosslake works to transform and optimize software delivery. In addition to functional skills in software development, Crosslake’s team of senior software professionals provides end-to-end support with expertise in management consulting and advisory services to provide both strategic and tactical insight. Crosslake is headquartered in Seattle, Washington (USA) and Tallinn, Estonia (EMEA). For additional information, please visit www.crosslaketech.com

Follow us on Twitter, LinkedIn, and Facebook.

Media Contact:

Victoria Steed, Director of Marketing

425.435.7389

[email protected]

Original Source: Crosslake's Hazem Abolrous to Speak at Operating Partners Forum, Europe's Premier Private Equity Conference